FREAK-y Stat of the Day: It's 2008 All Over Again

This Freaky stat comes courtesy of reader Benjamin Bias, who brought to our attention this oddity, as noted by Joe Weisenthal at Business Insider:

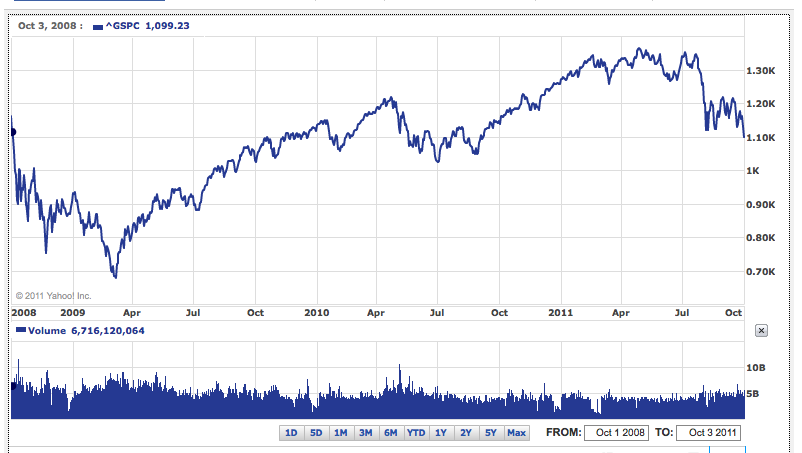

Yesterday, Oct. 3, 2011, the S&P 500 closed at 1,099.23.

Exactly three years ago, on Oct. 3, 2008, the S&P 500 closed at 1,099.23.

As if investors needed anymore reason to be nervous these days.

Comments