The Economics of Toilet Paper

You never know what kind of useful information will turn up in your in-box. From a reader named Darin Haselhorst:

Steven and Stephen,

Thought this might be right up your alley. An analysis only a true cheapskate could love.

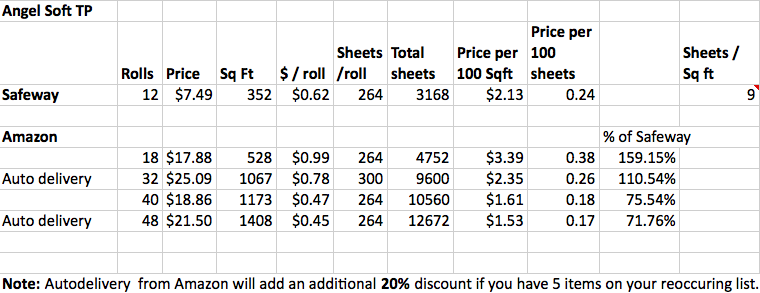

I get very frustrated trying to compare prices on “paper products” at my local supermarket, Safeway. They have various marketing terms meant to confuse the average consumer, regular, double, mega etc., making nearly impossible to compare prices on the spot. So, I threw together a little spreadsheet (attached).

The price as Safeway was not all that surprising until you compare it to the price for which Amazon is willing to deliver it to your front door. The Amazon Subscribe and Save program is about 30% cheaper than going to the store. Not too bad. If you have Amazon deliver 5 items on automatic delivery, they will take an additional 20% off the entire delivery. A deal any true economist simply cannot pass up.

Its surprising to me that Amazon is willing to deliver to your door for approximately half the price Safeway has on their shelf.

There must be a story out there about the rise of places like Amazon and Walmart.com attempting to replace your local vendors for everyday items. I know Walmart is toying with same day delivery and Amazon is testing delivery to neighborhood 7 Elevens for pickup. The infrastructure investment these companies are making must be incredible, just to bring me cheaper toilet paper.

Keep up the good work.

Comments