Google's New Correlation Mining Tool: It Works!

You may have heard of Google Trends. It’s a cool tool which will show you the ups-and-downs of the public’s interest in a particular topic—at least as revealed in how often we search for it. And you may have even heard of the first really important use of this tool: Google Flu Trends, which uses search data to try to predict flu activity. Now Google has released an amazing way to reverse engineer the process: Google Correlate. Just feed in your favorite weekly time series (or cross-state comparisons), and it will tell you which search terms are most closely correlated with your data.

So I tried it out. And it works! Amazingly well.

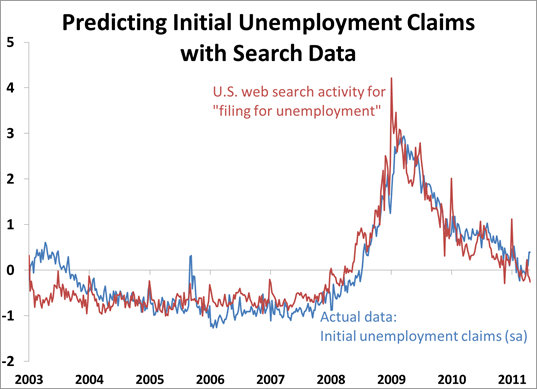

I fed in the weekly numbers on initial unemployment claims—one of the most important weekly economic time series we have. The search term that is most closely correlated? Crikey, it’s “filing for unemployment.” Indeed, the correlation is an astounding 0.91.

Given the latest Google Trends on “filing for unemployment,” I’ll forecast that initial unemployment claims will tick down in the next couple of weeks.

With an eye to earning a quick trading fortune, I also uploaded data on weekly returns on the S&P 500. But Google failed to find anything significantly correlated. Score one for the random walk hypothesis.

Interested in more? Here’s Google correlate; here’s a comic introduction; and here’s their white paper. Also, here’s Hyunyoung Choi and Hal Varian’s research on “Predicting the Present with Google Trends,” which shows that retail, auto, home and travel sales are also now-castable with search data (blog summary here); they’ve also previously shown the value of Google Trends in predicting initial unemployment claims. And here’s Albert Saiz and Uri Simonsohn on “Downloading Wisdom from Online Crowds.”

(Hat tip: Bo Cowgill)

Comments