If Handing Off a Family Business to the Next Generation, What's the Key Thing to Avoid?

What’s the difference in performance between a family business where the CEO hands off leadership to a member of the family versus an outside CEO? That’s one of the questions our latest podcast, “The Church of Scionology,” tries to answer. (You can download/subscribe at iTunes, get the RSS feed, or read the transcript here.)

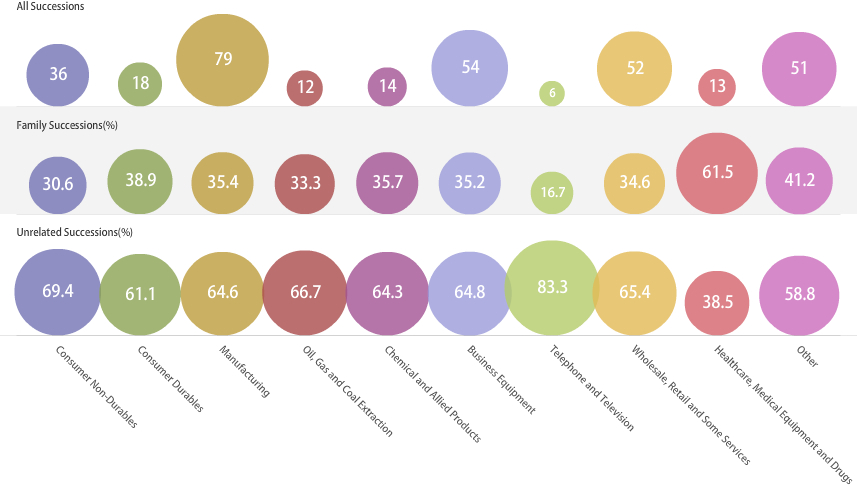

Stanford economist Francisco Pérez-González has looked at the data to try to figure this out. (His paper “Inherited Control and Firm Performance” can be found here). He compiled data from 335 management transitions across a number of industries with concentrated ownership or founding family involvement. He compared 112 blood-related successions to 213 unrelated ones. Here, first, is a breakdown of successions by industry, and by family-handoff within industries:

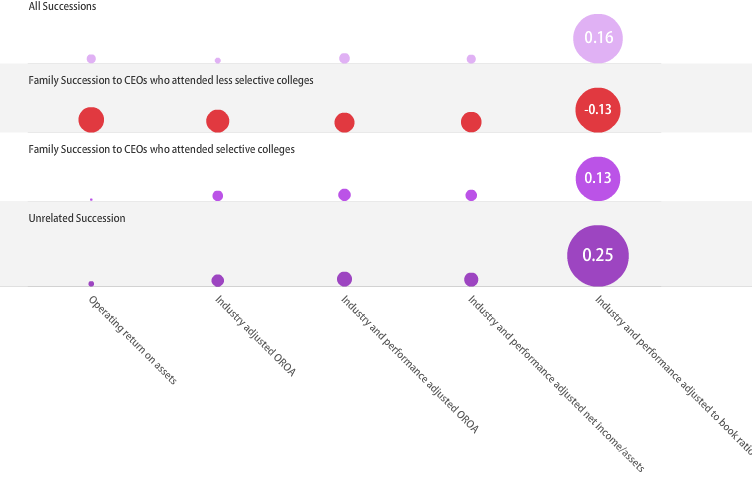

Pérez-González then measured operating return on assets (OROA) for these firms, since “OROA is a measure of current profitability, and arguably, the simplest measurement of overall firm performance.” He found that family firms that transition to family CEOs did experience a decline in unadjusted OROA, but very little difference in overall profitability.

Here’s his most significant finding (with a little bolding to highlight the a-ha moment):

A closer test of the nepotism hypothesis is to compare the performance of family CEOs when sorted by the colleges they attended. Under nepotism, family successors are more likely to be promoted to the CEO-post irrespective of merit. As a result, firms with family heirs who exhibit high motivation or talent might experience superior performance relative to those family firms in which the family CEO lacked them. Firms that promote unrelated CEOs, in contrast, are better placed to avoid this extreme lower tail in the performance distribution by promoting CEOs with a proven track record, and whose post-graduation professional experience before being appointed a CEO would likely outweigh the informational content of the college they attended.

The results are startling. Family CEOs who attended less selective colleges (LSC) account for the entire decline in performance observed by the group of firms that promote family CEOs. For them, OROA falls by 4.31 percentage points (27.7 percent decline relative to own pre-transition levels), significant at the one-percent level. More revealing, 40 out of the 54 observations in this group of family LSC CEOs or 74 percent are negative. In contrast, firms that promote family CEOs who attended selective colleges (SC) do not exhibit significant differences in operating profitability around successions.

Here’s what Pérez-González’s finding looks like:

And here’s the relevant portion of the podcast transcript:

PEREZ-GONZALEZ: The underperformance of family CEOs was basically explained by those family CEOs that do not attend, you know — forget about the most selective colleges in the U.S. If you’re in the top 30 college pool, you do fine. If you’re in the top 50 colleges, again you do fine. Or top 100, you do fine. It’s that in 40 percent of the cases in my sample were people who attended colleges outside the top 189 colleges in the U.S. despite having substantial wealth. So, these people that, say, maybe did not have the ability, or did not have the effort because they might be able, but they’re not encouraged to make huge effort. These were the ones that were driving, or dragging, the performance of the family CEO pool.

DUBNER: So, if you throw out the family firms who hand off the CEO position to a family member who went to a non-selective school, if you throw out those companies, then you find that family firms do as well as family firms who hand off to a non-family CEO, yes?

PEREZ-GONZALEZ: Statistically there’s no difference in performance.

DUBNER: So there you have it. The entire effect can be explained by a handful of family CEOs who just aren’t very good, or very smart, or very motivated. In other words: Junior isn’t necessarily cut from the same timber as dear old Dad – hard-working, self-effacing, up-from-the-bootstraps dad. Now, it should be said: This is hardly a new insight. Remember Max Weber? He wrote The Protestant Ethic and the Spirit of Capitalism – which you read, or pretended to read, when you were young. In 1904, Weber wrote that capitalism requires, and I quote, “a more individualistic form of entrepreneurship and the absence of nepotism.” Modern scholars have a name for this:

Vikas MEHROTRA: So this is called the Carnegie Conjecture.

DUBNER: That’s Vikas Mehrotra. He’s a finance professor at the University of Alberta in Edmonton. The Carnegie Conjecture goes back to Andrew Carnegie, who made a huge fortune in steel in the 19th century.

MEHROTRA: Right, so in his idea, he’s actually very clear on this, he did not mince words at all. In his idea, the inheritance of a fortune for the second generation, the heirs who inherited fortunes in his opinion it deadened their talents. And therefore it was incumbent upon rich tycoons and entrepreneurs and so on to distribute their wealth prior to their departure from this earth.

Comments