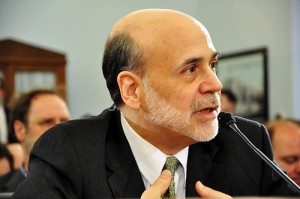

Bernanke Speaks. But What Did He Say?

Photo: Medill DC

Photo: Medill DCSo Ben Bernanke finally spoke today. And as I predicted yesterday, all the early headlines are expressing disappointment that he didn’t announce QE3. But this disappointment is misplaced. New policy announcements are for the Federal Open Market Committee (FOMC), not the Chairman. The most he could do is give an indication of where he thinks things will go.

And he thinks they should ease policy. Soon.

Here’s the case he made:

1. Unemployment is too high. This is the usual argument for easing monetary policy.

2. Inflation is below target. The usual constraint preventing this doesn’t bind.

3. The possibility that high long-term unemployment may persist “adds urgency to the need to achieve a cyclical recovery in employment.” There’s a special reason to be more aggressive.

4. “The growth fundamentals of the United States do not appear to have been permanently altered.” Dismissing the counter-argument that this is structural.

5. “[T]he Federal Reserve has a range of tools that could be used to provide additional monetary stimulus.” He’s not out of ammo.

6. The FOMC is now going to meet for two days instead of one to discuss how best to use them. They’ve got to figure out how to load the guns.

Reasons No. 1 and No. 2 are the standard case for monetary easing. No. 3 is the case for urgency. No. 4 poo-poos the naysayers. No. 5 says we can ease. No. 6 suggests he wants to. Add it up, and you have a slam-dunk case for monetary easing. And I think it’s the right case, too.

So I read this as Ben saying: “Here’s the case I’m taking back to the Federal Open Market Committee. When we meet, you’ll hear what they decide.”

This is really the strongest signal he could have sent. QE3—in some form or another—is on its way, probably in September.

The other highlight was Ben warning Congress against short-term spending cuts and fiscal shenanigans that could kneecap the recovery. I hope they’re listening.

Comments