Day After the Debate: Intrade Odds of Republican Candidates Securing Presidential Nomination

Photo credit: ROBYN BECK/AFP/Getty Image

Today, it seems that everyone has their own opinion on who helped themselves and who didn’t in last night’s Republican presidential candidates’ debate. And consensus is hard to come by, even in the same news room.

Take the Washington Post, for example. On its PostPartisan blog, first Richard Cohen wants us to think that Rick Perry was the “Big Loser” of the night. But then 90 minutes later, his colleague Marc Thiessen weighs in saying that Perry “had a very good night.” Rather than relying on Beltway journalists to decide who won and who lost, I figured: why not see what the market is saying? So I headed over to Intrade to take a look at the odds for who will wind up as the 2012 Republican Presidential Nominee.

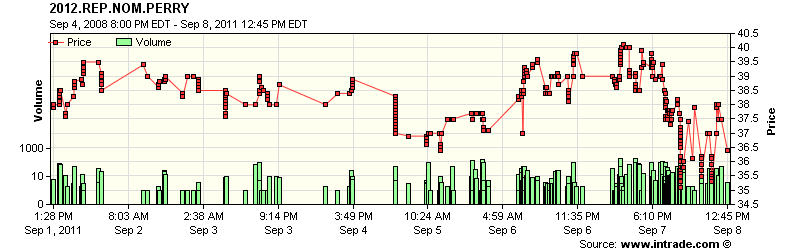

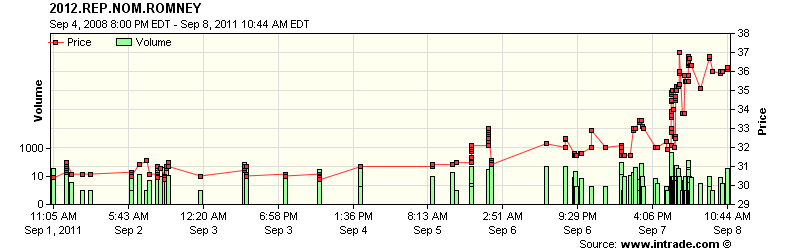

It does appear that Perry is slipping after last night’s debate. Even in the time it took me to put this blog post together, he’s lost a percentage point, going from 37.5% to 36.4%. While Mitt Romney has remained even so far today at 36.3%. These markets are of course fluid, but here’s a snapshot of the current Intrade odds for each candidate from last night’s debate, and how they’ve moved over the last week.

Rick Perry: 36.4%

Mitt Romney: 36.3%

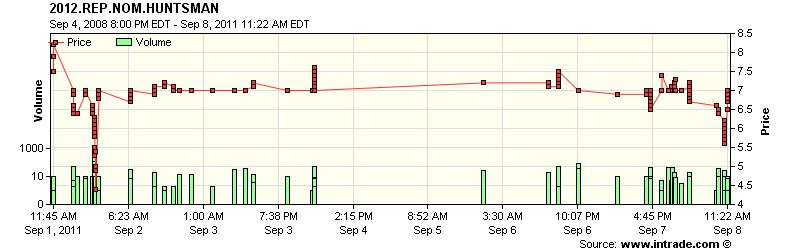

Jon Huntsman: 7%

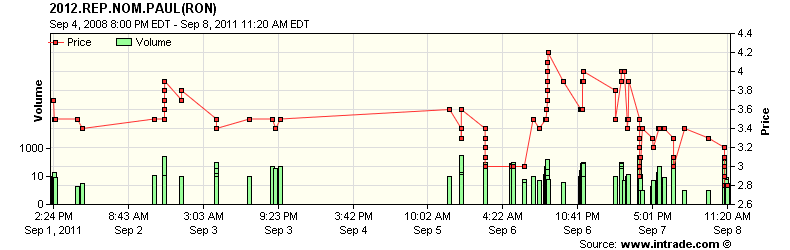

Ron Paul: 2.8%

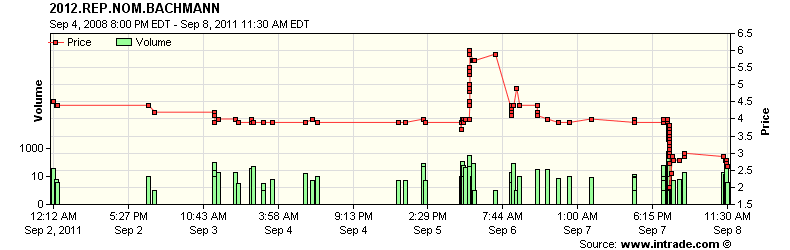

Michele Bachmann: 2.6%

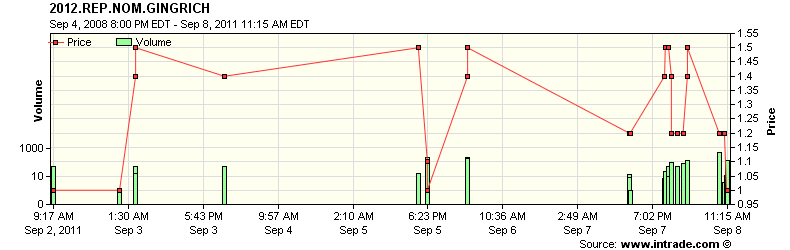

Newt Gingrich: 1.3%

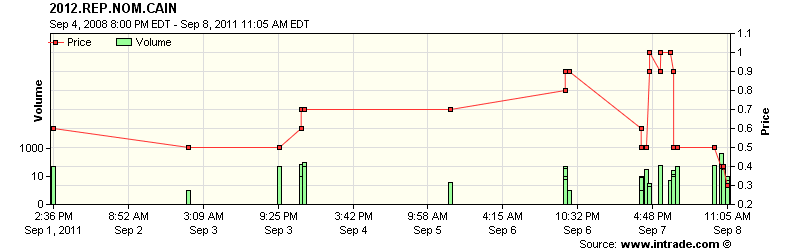

Herman Cain: .6%

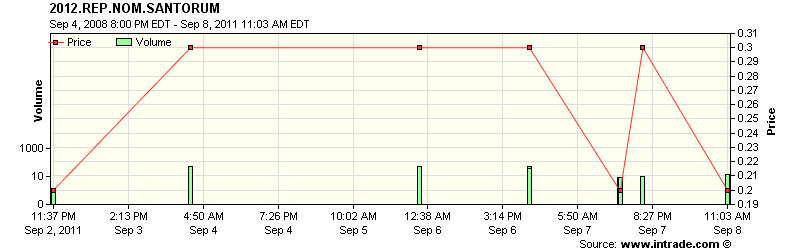

Rick Santorum: .2%

Comments