A Sports Economist’s Thoughts on Moneyball: A Guest Post by J.C. Bradbury

Photo: nxusco

Photo: nxuscoJ.C. Bradbury is a long-time friend and contributor to the Freakonomics blog. An associate professor of economics at Kennesaw State University, Bradbury is the author of two books on baseball: The Baseball Economist: The Real Game Exposed, and Hot Stove Economics: Understanding Baseball’s Second Season. For years, he covered the intersection of baseball and economics on his Sabernomics blog.

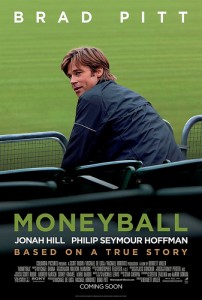

So with the new movie Moneyball out, we wanted to get J.C.’s thoughts on how well the book translates onto the big screen, and whether it does justice to the wonky, sabermetrics approach to baseball.

An Economist’s Thoughts on Moneyball

By J.C. Bradbury

When it was published in 2003, the book Moneyball generated a buzz in the field of economics because it covered several topics economists like, such as constrained maximization, market efficiency, entrepreneurship, and statistical analysis. To most people, economics is boring: it’s a class they took because they had to. Author Michael Lewis introduced important economic concepts through a venue that millions of Americans pay to watch. As a book, it succeeded, but I was skeptical that it could work as a movie. I was wrong. Even my wife, who only reluctantly agreed to see the movie with me, enjoyed it.

The movie doesn’t disappoint in covering any of the book’s economic themes, and as with most movies it’s best not to let divergences from reality (Scott Hatteberg and Chad Bradford were regulars on opening day) or exaggerations (the acrimonious tension between general manager and manager) distract from the main point.

The 2002 Oakland A’s should have been doomed. The A’s had a $40 million budget to compete not only with the $125 million payroll of the Yankees, but against 28 other teams with average payrolls approaching $70 million. As A’s General Manager Billy Beane (Brad Pitt) puts it in the movie (and I’m paraphrasing from memory), “There’s rich teams, there’s poor teams, there’s 50 feet of crap, and then there’s us.” It was an unfair game. Beane informed his staff that if they were going to play like the Yankees off the field when finding talent, then they would be losing to them on the field.

The only way the A’s could win in a world like this was to innovate by finding new knowledge about how to win. Beane turns to Peter Brand (Jonah Hill), an economics major from Yale who was not entrenched in old-school baseball mentality. (The fictional character Brand is based on Paul DePodesta, a Harvard economics major.) According to Brand, current baseball thinking was medieval; beliefs about player value were shaped by biases that caused players to be mis-valued. This market inefficiency would allow the A’s to field a competitive team within their budget by buying wins for less.

Using statistical analysis and ideas popularized by sabermetrician Bill James, but largely ignored by baseball insiders, the A’s found good players they could afford. They turned to three seemingly flawed players—Scott Hatteberg (bad arm), David Justice (old), and Jeremy Giambi (unathletic with off-field issues)—who had one important skill that the market undervalued: getting on base. The A’s found relief pitcher Chad Bradford, who was unwanted because he threw the ball in an unconventional way and not very fast. But Bradford stopped opposing players from getting on base, it didn’t matter to the A’s how he went about doing it.

Many people have criticized Moneyball because of the A’s focus on sabermetrics, which challenges many tenets of baseball’s hallowed conventional wisdom. They argue its focus on numbers dehumanizes the game and ignores the intangibles that only trained scouts can see. Though sabermetrics is an element in the story, it’s not really what Moneyball is about.

More broadly, Moneyball is a story of innovating to succeed, or as Beane puts it in the movie, “adapt or die.” Beane was an entrepreneur who was innovating out of necessity. What he did in Oakland was no different from what other great innovators have done before him. Famed General Manager Branch Rickey couldn’t afford to stock his club with top players when he took over the inept St. Louis Cardinals, so he started his own minor-league farm system where he could grow his own talent that he could use or sell to his big-league competitors at a premium. Rickey would later move on to the Brooklyn Dodgers where he would lead another flailing franchise to success by exploiting an underpriced input—African American players, who were barred from the major leagues by a “gentlemen’s agreement.”

When Rickey explained why he signed Negro League players like Jackie Robinson he sounded more like a pragmatist than a civil rights pioneer (which he was). “I signed them because of my interest in winning a pennant. If an elephant could play center field better than any man I have I would play the elephant,” he famously said. Using sabermetrics as their guide, Beane and Brand found their elephants.

But as critics of Moneyball have been quick to point out, Beane’s A’s have never reached the World Series. In the past five seasons, the A’s have been downright awful, averaging only 76 wins per season. If the A’s had such a good idea, then what happened? The answer is the same thing that follows every great innovation: imitation. The A’s frugal success didn’t go unnoticed or unappreciated despite how much baseball insiders may have protested. Just as Branch Rickey saw his farm system become the industry standard, and other teams hired Negro League stars to bolster their rosters—thereby eroding the financial gains from these innovations—Beane saw his ideas spill over and spread to other teams. Economists Skip Sauer and Jahn Hakes verified the observation that getting on-base was undervalued in the baseball labor market at the time Moneyball was written, but they also found that the underpricing had disappeared within a year of the book’s publication. Established sabermetric principles were low-hanging fruit that have been quickly harvested, and now the A’s, along with every other team in baseball, have to find new ways to gain an edge.

Moneyball offers a snapshot in the life-cycle of what economist Joseph Schumpeter called “creative destruction,” where innovations replace existing methods with superior and cheaper methods. For example, as the music industry progressed from records to cassette tapes to CDs to MP3s, makers of vinyl, magnetic tape, polycarbonate plastic saw their fortunes rise and fall, while society ultimately benefited from access to higher quality and cheaper music. The Moneyball innovation was just a step in the process that is ongoing, and we are lucky that Hollywood was able to capture this lesson for us in such an enjoyable way.

Comments