Computers vs. the News: What's Behind the Stock Market Chop?

(iStockphoto)

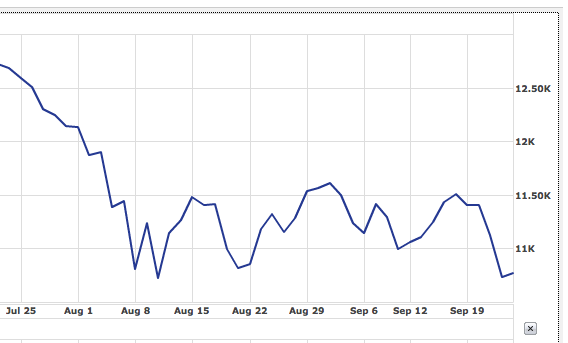

Today marked another triple-digit move for the Dow Jones Industrial Average, which closed up 272 points. Of the 45 trading days over the last two months, 28 of them (including today) have seen triple-digit moves, meaning the Dow has gone up or down by 100 points (or more) 62% of the time since July 25. The average daily move for the Dow during that time has been 188 points, or 1.6%. Here’s a snapshot showing the performance of the Dow over the last two months:

Pretty choppy, right? I’m no stock market historian, but I’d imagine that you’d be pretty hard-pressed to find such a sustained period of volatility. Which brings up the question: what’s causing this? Obviously, there is a lot of uncertainty (and fear) in the market right now. From Europe’s sovereign debt problems, to America’s toxic political climate, to the sputtering global economy, there is a lot to be anxious about. Anxiety breeds indecision, which characterizes the bumpy market pretty well.

There’s also been a lot of speculation about how much high frequency traders are driving the choppiness. These guys are pretty much the only ones who have been consistently making money the last several weeks. High-frequency traders feed off of volatility. No matter which way the market moves, they can make money by taking advantage of tiny price differentials, trading in and out of stocks in fractions of a second. But feeding off of volatility is very different from causing it.

In a recent op-ed, Manoj Narang, founder of the HFT shop Tradeworx, insists that high-frequency trading is not driving volatility. Rather, it’s media exposure and access to markets that is really driving it. Narang writes:

From 2000-2006, the S&P 500 moved an average of 0.37% per day when the market was closed (that is, between the close of one day and the open of the next), whereas from 2007 onward, it moved 0.61% per day during this period, a 65% increase. Logically, it is impossible to blame high-frequency traders for this 65% rise in close-to-open volatility, because there is no trading when the market is closed. This volatility reflects one thing and one thing only — markets react to news, and since 2007, there has been an abundance of news which has caused investors to panic.

This 65% increase in volatility is particularly revealing when it is juxtaposed against the comparable difference when the markets are open. From 2000-2006, the S&P 500 moved an average of 0.76% between the open and close of the same day, compared with 0.85% since 2007. In other words, volatility during trading hours has increased only 12% during the exact same period when volatility during non-market hours has increased 65%, less than a fifth of what would be expected.

Still, regulators remain increasingly skeptical about the world of computer-driven trading. According to a Reuters report earlier this month, the SEC and FINRA have asked high-frequency firms to hand over details about their proprietary trading codes. It remains to be seen whether they hold any secrets to what’s behind all the market volatility.

Comments