Wondering Why Nations Fail? Bring Your Questions for Daron Acemoglu and James Robinson

When it comes to economic ideas, Daron Acemoglu never thinks small. Widely acknowledged as one of the most insightful economists alive, Daron seems to have brilliant things to say about any and all things economic.

When it comes to economic ideas, Daron Acemoglu never thinks small. Widely acknowledged as one of the most insightful economists alive, Daron seems to have brilliant things to say about any and all things economic.

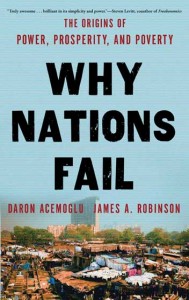

When you have that sort of gift, you might as well go after the biggest problems imaginable. Thus his latest book, Why Nations Fail, written with Harvard political scientist James Robinson.

It is an awesome piece of work. So full of ideas and wisdom, but still so easy to read. I just love it. Daron and Jim have agreed to take your questions about their new book, so please leave them in the comments section below. To get you started, here’s the table of contents:

Preface: Why Egyptians filled Tahrir Square to bring down Hosni Mubarak and what it means for our understanding of the causes of prosperity and poverty

1. So Close and Yet So Different: Nogales, Arizona, and Nogales, Sonora, have the same people, culture, and geography. Why is one rich and one poor?

2. Theories That Don’t Work: Poor countries are poor not because of their geographies or cultures, or because their leaders do not know which policies will enrich their citizens

3. The Making of Prosperity and Poverty: How prosperity and poverty are determined by the incentives created by institutions, and how politics determines what institutions a nation has

4. Small Differences and Critical Junctures: The Weight of History: How institutions change through political conflict and how the past shapes the present

5. “I’ve Seen the Future, and It Works”: Growth Under Extractive Institutions: What Stalin, King Shyaam, the Neolithic Revolution, and the Maya city-states all had in common and how this explains why China’s current economic growth cannot last

6. Drifting Apart: How institutions evolve over time, often slowly drifting apart

7. The Turning Point: How a political revolution in 1688 changed institutions in England and led to the Industrial Revolution

8. Not on Our Turf: Barriers to Development: Why the politically powerful in many nations opposed the Industrial Revolution

9. Reversing Development: How European colonialism impoverished large parts of the world

10. The Diffusion of Prosperity: How some parts of the world took different paths to prosperity from that of Britain

11. The Virtuous Circle: How institutions that encourage prosperity create positive feedback loops that prevent the efforts by elites to undermine them

12. The Vicious Circle: How institutions that create poverty generate negative feedback loops and endure

13. Why Nations Fail Today: Institutions, institutions, institutions

14. Breaking the Mold: How a few countries changed their economic trajectory by changing their institutions

15. Understanding Prosperity and Poverty: How the world could have been different and how understanding this can explain why most attempts to combat poverty have failed

Daron Acemoglu is the Killian Professor of Economics at MIT and a 2005 John Bates Clark medalist. James A. Robinson is the David Florence Professor of Government at Harvard University.

This post is no longer accepting comments. The answers to the Q&A can be found here.

Comments