Mistrust and the Great Recession

Photo:? AgnosticPreachersKid

Four years ago, 75% of Americans said that they had confidence in financial institutions or banks. Following the financial crisis, that number has fallen dramatically, to 45%. This well-earned public mistrust may be yet one more factor retarding the recovery of the financial sector, and possibly the broader economy. Survey data also show that trust in government is also currently at an historic low. The effects of this can be seen every day in our political dialogue. And I fear that this demagoguery has made it more difficult for policymakers to respond aggressively to our current economic malaise.

Betsey Stevenson and I document this decline in trust in our new working paper titled “Trust in Public Institutions Over the Business Cycle.” You can either read the paper here, or Justin Lahart’s splendid write-up in today’s Wall Street Journal, here.

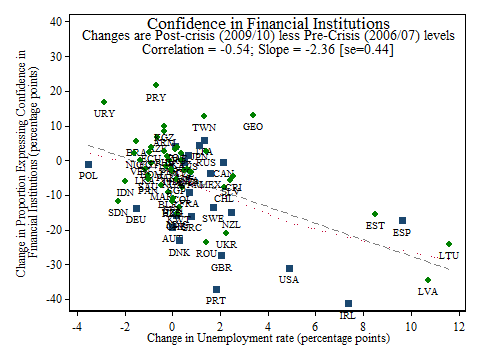

The key fact we document is that those countries hardest hit by the Great Recession also experienced the largest declines in trust. First, here are the data for trust in financial institutions:

The correlation between declining trust in financial institutions and rising unemployment is pretty darn strong. Interestingly, this relationship about as strong for OECD countries (the blue dots) as for others (the green diamonds). The relationship also looks to be pretty linear. (The red line shows a lowess fit.) Even relative to this strong correlation, the decline in the US is particularly large. Interestingly, the Irish experienced an even larger decline in trust.

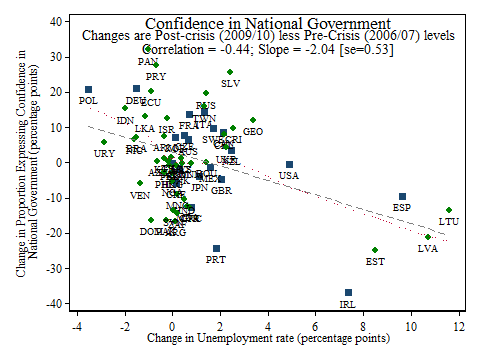

Turning to trust in government, the pattern is remarkably similar, although this time the mood in the US is closer to what you might expect, given the rise in unemployment:

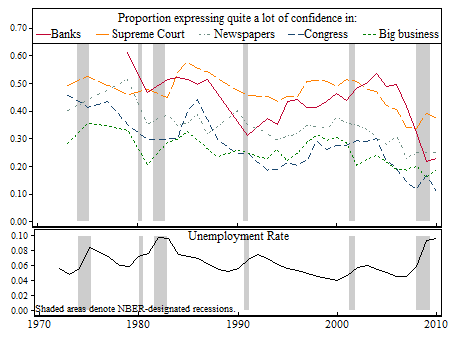

We have evidence from other Gallup surveys that this recession has wrought a particularly sharp decline in the trust Americans have in banks, big business, and in Congress – although the latter is definitely part of a longer-run trend.

The bigger question here is whether this trust is easily rebuilt. Many economists – myself included – have long been worried that today’s recession can ruin tomorrow’s recovery. Typically, these “hysteresis” stories are based on concerns that the jobless lose skills, and lose hope, and so aren’t ready to work when the jobs return. But perhaps these data suggest we should also be worried that recessions destroy the valuable stock of trust that can sustain a booming economy. And if trust really is essential – still an open question, to be sure – perhaps these data provide one more reason to fear that the current malaise may persist.

The bigger question here is whether this trust is easily rebuilt. Many economists – myself included – have long been worried that today’s recession can ruin tomorrow’s recovery. Typically, these “hysteresis” stories are based on concerns that the jobless lose skills, and lose hope, and so aren’t ready to work when the jobs return. But perhaps these data suggest we should also be worried that recessions destroy the valuable stock of trust that can sustain a booming economy. And if trust really is essential – still an open question, to be sure – perhaps these data provide one more reason to fear that the current malaise may persist.

Justin Lahart expounds at greater length in the accompanying WSJ video, below:

Comments