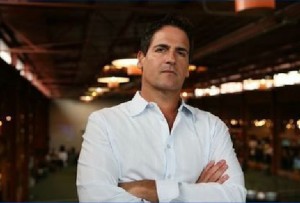

"Never Follow Your Dreams": Mark Cuban Answers Your Questions

Last week, we solicited your questions for Mark Cuban — serial entrepreneur, Dallas Mavericks owner, and blogger, who recently published an eBook called How to Win at the Sport of Business.

Last week, we solicited your questions for Mark Cuban — serial entrepreneur, Dallas Mavericks owner, and blogger, who recently published an eBook called How to Win at the Sport of Business.

Here now are Cuban’s answers. A lot of answers. Granted, most of them are short but Cuban can pack a lot into a terse words (unlike a few million politicians and businessfolk we know). He has some strong words on financial engineering and, if you read carefully, lots of good career advice. My hands-down favorite: “Never follow your dreams. Follow your effort.”

Thanks as always to you for the good questions and especially to Cuban for taking the time to answer them.

Q. I love pro sports, but I don’t think cities should be picking up the tab for things like championship parades — so kudos to you for paying for the Mavs’ victory parade out of your own pocket. Can you please convince your fellow owners to do the same whenever they win titles? –Rogah

A. Everyone should make their own decision.

Q. I’m a high schooler in Detroit. I just read something interesting the other day about my hometown — specifically that Detroit’s 14 largest employers, which have among them roughly 75,000 workers, are dominated by public organizations such as government entities, city and school systems, and health care companies. None of these entities pay taxes! It shouldn’t be a surprise that our city is in financial trouble. Do you think that Detroit will go away and never come back? Should I go to college out-of-state and plan on staying there? Is it likely (> 50 percent chance) that Detroit will come back? –Terry

A. I think that Detroit is undergoing a renaissance that will allow it to blossom. The first step is to revitalize its schools, and I know there are steps being taken. As far as business expansion, I know Dan Gilbert and others have been very excited about what they see going on in Detroit. It will just take time. The best way you can impact Detroit is to reach out to your classmates and encourage everyone to stay in school and go on to college.

Q. I graduated with an undergrad engineering degree from MIT. I currently work in finance, as do the majority of my engineering classmate friends. This strikes me as a shame, specifically that many well-trained young engineering/tech minds aren’t working in technology. Seems like a lot of brainpower is spent “innovating” finance. What’s your take on this? Is this a problem? If so, what could be done? –Milt

A. I agree with you. It is a huge problem. We have too many bright grads concentrating on “financial engineering” rather than actually making something and contributing to society. I think we will see tax and regulatory policy that will reduce the incentives and increase the friction for those who “hack” the stock market and focus on financial engineering. Which, in turn, hopefully will incentivize you and others to enter other disciplines.

I am in favor of a “Tobin Tax” which taxes many financial transactions with the goal of returning the stock market to its original purpose of being a market designed to raise capital for growing businesses of any size.

I also think we should increase taxes on carried income earned by funds.

If we can get the stock market back to its roots, then there will be far more capital available to companies of all sizes. That will increase the number of IPOs and secondaries by making it easier for companies to access markets directly, not only creating funding for those companies, but also creating incentives for early stage investors to take risks knowing there is a better chance they can create liquidity through an IPO.

Going public has become an opportunity available to the “1%” of companies with great pedigrees and huge investment funds already in place. We need to open it up to the other 99 percent of companies who need capital to grow.

Q. My father immigrated to the U.S. in the 1970s. He came with nothing and has done very well for himself and his family. He feels that America has lost its way, specifically that Americans don’t work as hard as they used to, don’t work as hard as people in emerging countries, and have a belief that they are entitled to things (such as markets that always go up, that the government should take care of them, that they don’t have to plan for retirement). I wholeheartedly disagree with my father. Whose side would you take? –Wes

A. He is right. But so was his father when he told your dad how much harder he worked. Productivity has increased generation by generation. Things change. Remember, you never live in the world you were born into.

Q. Let’s say that all of the NBA owners are called to a conference room for a meeting with David Stern. All of the owners show up. You look around. Who’s the smartest guy in the room? –Hollins

A. Depends on the topic.

Q. The annual increase in the cost of college tuition seems to be much greater than inflation every year. Even during the recent financial crisis, tuitions were generally going up across the board! Seems like this is a problem waiting to happen. Do you think that we’re going to get a point soon where it won’t be a good investment to go to a private university unless you know that you’re going into a lucrative field (finance, computer science, medicine, economics)? Asked another way: my friend is going to a $40k/year private university to study finance. Is this likely to be a bad investment? –Stocker

A. We are already there. The return on education investment at a school is becoming less about the quality of education and more about the quality of networking available from that university’s alumni base.

If it were up to me, I would look very closely at limiting the size and total amount of student loans that can be federally guaranteed to $5k per year in 2012 dollars. If we limit the amount of money available in loans to students, we would create several improvements in this country:

- Universities would become more efficient. They would have to separate education from all the other things that universities pride themselves on.

- We would improve the economy and help protect the future of our kids. I think most people who look at these things fail to realize that graduating from college no longer means the entry of a “mature consumer” into the market who will rent an apartment, buy a car, buy clothes for work, etc. Instead, we get indentured servants whose only goal is to try to figure out how to not spend money so they can pay back their student loans!

Q. It seems that there is a mismatch between the skills that employers are looking for today and the skills that are being developed by college and high school graduates in the U.S. This seems like a huge problem to me. Do you see this mismatch yourself? What should (or could) be done about this? –Mickey

A. You will see new types of “trade schools” pop up to meet this demand. Six-

, eight-, ten-week courses that are taught not by traditional schools, but by the new generation of trade schools that focus on programming skills, welding skills, whatever skills employers are looking for. But rather than these being accredited by educational institutions, they will be branded with the names of well-known individuals and brands.

So you could see the “Mark Cuban School of Programming” or “The Mark Cuban School of Selling.” They will be designed to give you the specific skills employers are asking for in the shortest period possible.

Q. I really enjoy math and will be studying something math/science/computer-related as an undergrad. I’ll try to pick something that I enjoy the most. That being said, which specific areas of tech do you think will be hot/relevant 10 years from now? –Dutch

A. The most important thing you can do at school is learn how to learn. The only thing I can tell you with certainty is that things will change and those that enjoy learning on a daily basis will easily be able to take their math/science/computer degree and evolve to be good at whatever it is they want to do in 10 years.

Q. I saw your Entrepreneur article, which featured your list of “12 Rules for Startups,” and, via a Google Books sample, I also saw your dozen Mantras for Success. Do you have a 13th rule or mantra on the subject of growing vs. selling your company? How do you judge when it is best to turn down a buyout offer, and when it is the right time to sell your company? As Dubner pointed out, your sale of Broadcast.com was particularly well-timed. –Tony D

A. Where you take a company depends on your personal goals. Where you want to be in five, ten, twenty years and the type of lifestyle you want to live will dictate your decision-making process.

Q. You have received a lot of attention for your big ideas, risks, success, and personality. It’s as if every day is a big adventure in your life. But in reality, we never see what’s going on behind the scenes. How do you stay motivated and keep everything new/exciting on the average day, when you just have to get up, go to work, and get stuff done? –Elliot Millican

A. I’m so competitive its easy for me to stay motivated. I just want to win at the goals I set.

Q. I am glad you are on one of my favorite shows, Shark Tank, and that you are still out for another stream of income. What precautions do you take to make sure your money doesn’t go down the toilet? –Arthur

A. I stick to areas I know. If you notice on Shark Tank, I will be the first to admit if I can’t add value to a company. If I can’t add value, I won’t invest. If I can add value, I will try to figure out whether I can add enough value to the existing company to create a return.

Q. As a fellow Hoosier basketball fan and IU alum, I’d like to ask: To what do you attribute most the revival of Indiana basketball? –Michael Berbari

A. Great coaching and great recruiting.

Q. I read you put in a bid in to buy the Dodgers. You are a proven competent business/sports franchise owner, therefore it’s within your realm of expertise. Why do athletes (Kobe, Lebron, Gasol, Garnett, Nash) buy professional teams overseas? It seems to me like there is much more inherent risk to investments overseas for reasons such as currency valuation, accounting standards, language barriers, laws, etc. I am not totally informed on all the variables, but what are some pros and cons to overseas investments in sports franchises? –Juan

A. It’s not too expensive, and I’m guessing they have fun with it.

Q. How can I, as a private citizen, get someone with access to the President’s inner circle to listen to my ideas? Just listen. That’s all I ask. –Mark Wolfinger

A. I have the same question. If you find out, let me know.

Q. No joke, I had a dream recently that you and I were hanging out at a bar talking sports over a few draft beers. Among other things I don’t recall, you said that you could turn the NFL’s Cleveland Browns into a winning outfit again. Is this true? What do they need to win? –Achilles

A. The first part wasn’t a dream. We were having a great time until you passed out. That must have been when you dreamed the second part. 🙂

Q. Almost finished your book. Although I have yet to venture, I truly have an entrepreneurial spirit. How do you articulate to others that feeling? When they say you’re crazy, and you just want to give it a shot? Also, if you get into baseball you will have a 21st century vision in a 20th century good ol boys league. How do you see yourself handling the pushback? –Jeff

A. You stop worry about articulating it to others. You just do the homework and get after it!

Q. Wow! A motor that runs on water and would generate an income for the user gets a thumbs down…tough crowd, or you have not read my blog nor my business plan. If you feel that water supply is the issue, I must point out that Einstein said we cannot create nor destroy matter, and water exists in one of three states — a solid (ice), a liquid (water), or vapor (steam) — therefore we still have the same amount of water now as there was 200 years ago.

The laws of thermodynamics were established circa 1850, and do not account for the phenomena of Light Amplification through Stimulated Emission of Radiation, which was theorized by Einstein in 1917 (that guy again) and perfected circa 1950. And if you do not know or perhaps forgot, the characteristics of light wave refraction cause light to be emitted 90 degrees from the point of incidence (meaning that light will travel at a 90 degree angle (perpendicular) to the surface that it comes from; therefore, by incorporating a plano-concave lens, the light (700deg) will be dispersed over the entirety of the 200 deg water. I hope this helps to understand my vision. This is possible. I have worked for over 20 years to try and disprove it, and believe me I understand the thermodynamic laws and over unity, but this has never before been done in the manner I am purposing.

Please look at my business plan. Expanded Technologies is my company name. This is an industry that will bridge the gap between what we have dreamed of and reality.

A 100 percent electric society is now possible. We will usher an evolution in energy production. This is the birth of an industry, an industry that will lead the world toward prosperity. –Steven Griffitts

A. I’m going to tell everyone exactly what I think when I get pitches like this. Pitches in areas that I don’t know anything about. A fact that should have been very easy for the entrepreneur to ascertain quickly online.

Since they know I’m not an expert, they bring it to me hoping they can sucker me in and get cash from me. I’m guessing they only bring it to me because they have already been turned down by those who know this space, or the entrepreneur knows its all bullshit and they dont want to be laughed out of an experts office.

I wouldn’t touch anything like this, no

matter what the blog says.

Q. I did not follow the lock-out all that closely, but the prevailing sentiment in the media seems to be that nothing was really solved or fixed. Do you think what was put in place is a long-term solution to the problems that plagued the NBA? –Ryan

A. No. Not even close.

Q. You emphasis the importance of sales in your book, but in each scenario it comes from a situation where the company is selling an excellent product. You also mention it is valuable for pretty much anyone to work in sales for a few years. My question for you is how do you sell a product that is not excellent by any measure. How do you sell a product that is only “meh”? –Nick

A. Are there other sales people selling the product? Is the company successful? Someone must be doing a great job selling it or the company would be out of business or on its way there.

I would find out what the other sales people are doing to sell and do a better job of doing what they do.

Q. At 2929 Entertainment, do you personally read projects at the script stage? Or do you only involve yourself further along into production? What are you looking for in a film project, as I assume that you are the one who would give the final green light to any project. –Bob

A. I don’t get involved in scripts at all any more.

Q. What was the hardest lesson for you to learn on your road to success? –Doug C.

A. You have to re-earn your customers’ business every day, or someone will take that business from you.

Q. In case you hadn’t realized, you are already very rich. However, you continue to do things to build your personal brand and your portfolio. Whether it be looking cool on Entourage, writing business books to help young entrepreneurs, yelling at the NBA, or putting your money on the line and looking cool on Shark Tank, what drives you to continue to work so hard and seek additional success? –Adam

A. 1. I’m incredibly competitive and business is the most compelling, competitive sport on the planet. 2. I don’t want to look back when I’m 95 and wonder why I said no to things that could have been fun, like Entourage, Dancing with the Stars, Shark Tank. It’s not about building a brand. It’s only about having fun.

Q. Mark, do you think capital gains should be taxed at the same rate as ordinary income? 15 percent vs. 35 percent. –Joe

A. No, but I would have no problem increasing capital gains to 20 percent or 22 percent. I am against an “Alternative Minimum Tax” for capital gains. That would completely change any investor’s approach to investing and could have enormous, unintended consequences.

Q. Imagine you just graduated now. What area of tech would you go into to make it big if you would have to start over: ecommerce, mobile, social gaming, something else?-Feyyaz

A. I would get into sales anywhere in the technology field.

Q.What is your best advice for sales professionals today? –Jamie

A. It’s a numbers game. You have to put in the hours to be prepared, and the hours networking and communicating with prospects and customers. The more effort you put in, the more money you will make.

Q. You’ve been widly successful in everything you’ve done with the Mavericks, and I know you were a rugby player in college. Any interest in working with rugby in your future?

A. I’ve considered it, but it’s too big a project relative to the time I have available.

Q. Why do you think the growth rate of compensation for C-level executives in public companies has outpaced the rest of the economy so drastically over the last 30 years? This seems a bit counterintuitive considering they accept less personal risk than executives of private companies, have less control due to an increase in the number of stakeholders and bureaucratic inertia, and generally seem to make poor economic decisions (not utility maximizing).

A. Because of the growth in stock compensation, executives are heavily incentivized to push up stock prices and continuously grant themselves more stock and options, which in turn creates more disparity in income, not only relative to front line employees, but also to individual shareholders.

An easy solution is to make companies pay their execs in cash. Cash impacts operations, so a greedy exec couldn’t just put all of a company’s cash in his own pocket. On the flip side, they could use that cash to buy all the stock and options they could afford to buy.

Make payments in cash, and you will see things change 180 degrees.

Q. I manage a direct sales team that sells a document management software solution for small-med size businesses. I think cold calling is a losing battle as the market is too noisy and sales cycles are too long. Instead, I would like to invest energy/money into SEO and PPC and grow the sales team as leads grow. Cold call vs. SEO/PPC? – Matt

A. You need to do both. Both are very noisy. You just have to learn from your experiences and become good at both.

Q. I am a senior at Texas Tech University majoring in Sports Marketing & Management. What advice would you have for me once I graduate in May? –Drew

A. Find a job anywhere but in sports management. Too few jobs, and too many people trying to get them.

Q. I am an outstanding writer. I’m a pretty decent business mind (just graduated with a BS/BA). The problem? I am having trouble choosing between business, journalism, or a combination of both. Clearly, the business arena made you your money, but how was the book writing process?

I wish I was a dumb kid that could live on ramen and have 6 roommates, but in reality, I’m a 40-year-old with a family. The day job is horseshite, but it pays the bills, and I lack the testicular fortitude to venture out. Not with small children to look after. Pearls of wisdom, spew forth? –Kelly C

A. If writing a book is important to you, take the time to figure out how to publish an ebook. It’s simple to get done. The challenge is doing the work to make people aware of the book and to want to buy it. That takes time. You have to decide if you want to make that investment to make it work.

Q.What skill did you not naturally have that you had to learn to first become successful? On the flip side, what was your natural skill/attribute that most contributed to your success? –Joe

A. I knew nothing about computers. I taught myself everything. The attributes that most contributed were my willingness to work as hard as it takes to win and to be able to focus.

Q. I think the NBA refs are probably the best in the world and generally want to call the game right. But personal bias and crowd influence make it impossible for a ref to fairly ref a game among these large, very quick men. I am among at least several sports fans that consider the NBA unwatchable because of the uneven officiating that cannot only influence but alter the outcome of games and even series. What can be done? –Larry

A. Trust me, I’m still working hard to help the league improve its processes. Like any other profession, there is still room to im

prove.

Q. When making decisions related to business, would you base it 100 percent on pure facts and numbers, or gut feelings, or a mix? How much does each play into your decision-making and have you ever regretted the choice? –Ryan

A. I ask myself what puts me in the best position to make a good decision. Do I have the info I need or not? If I do, I make the call. If I don’t, I work to get whatever info I need until I’m ready to make the call.

Q. I know you have heard this a trillion times, but there are a lot of people with common and boring jobs out there who would like to change careers and enter the business of sports. Would you recommend they follow their dreams and do whatever it takes to enter the business, or would you say that when you hit a certain age (let’s say 30) you should focus on life and forget about certain unattainable dreams? –Pete Incaviglia

A. Never follow your dreams. Follow your effort. It’s not about what you can dream of. That’s easy. It’s about whether or not it’s important enough to you to do the work to be ready to be successful in that business.

Comments