Kerwin Charles, Erik Hurst, and Matt Notowidigdo on the U.S. Labor Market

Three of my colleagues and friends at the University of Chicago — Kerwin Charles, Erik Hurst, and Matt Notowidigdo — recently presented some new research that aims to understand the ups and downs in the U.S. labor market. It’s more serious and important than the usual stuff we deal with on the blog, but every once in a while we deviate from trivialities when something really good comes along.

They’ve been kind enough to put together a layperson’s version of the research below. For those looking for the full-blown academic version, you can find that here.

A Structural Explanation for the Weak Labor Market

By Kerwin Charles, Erik Hurst, and Matt Notowidigdo

In the aftermath of the Great Recession, the labor market has remained anemic. Between 2007 and 2010, the employment-to-population ratio of men between the ages of 21 and 55 with less than a four-year degree fell from 82.8 percent to 73.8 percent. As of mid-2012, the employment-to-population ratio for these men remained depressed at 75.6 percent.[1]

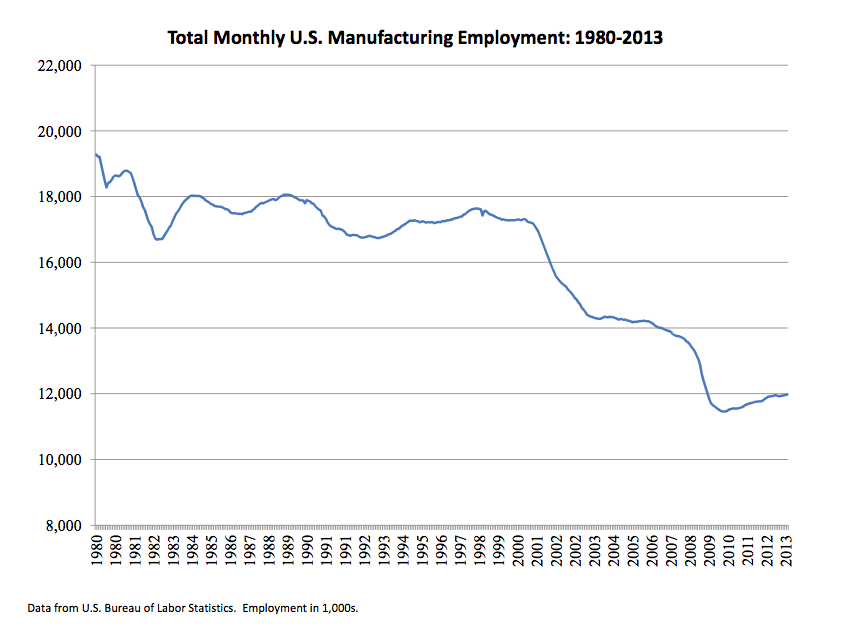

In our new working paper (abstract; full PDF), we show that the recent sluggish labor market in the U.S. – particularly for prime age workers without a college degree – can be traced back to the large sectoral decline in manufacturing employment that occurred during the 2000s. After decades of relative stability, total manufacturing employment in the U.S. fell by 3.5 million jobs between the beginning of 2000 and the end of 2007 (see chart below). These manufacturing jobs were lost even before the Great Recession started. During the recent recession, another 2 million manufacturing jobs were lost. While there is talk of a recent manufacturing rebound in the U.S., the recent increase is only a tiny fraction of the total manufacturing jobs lost during the 2000s.

Despite the massive decline in manufacturing employment between 2000 and 2007, the employment-to-population ratio for prime age men with less than a four year college degree only fell by 2 percentage points between 2000 and 2007. As we show in our paper, the reason that the manufacturing decline had such a muted effect on the aggregate labor market during this time period was because the U.S. economy was simultaneously experiencing a surge in housing demand.

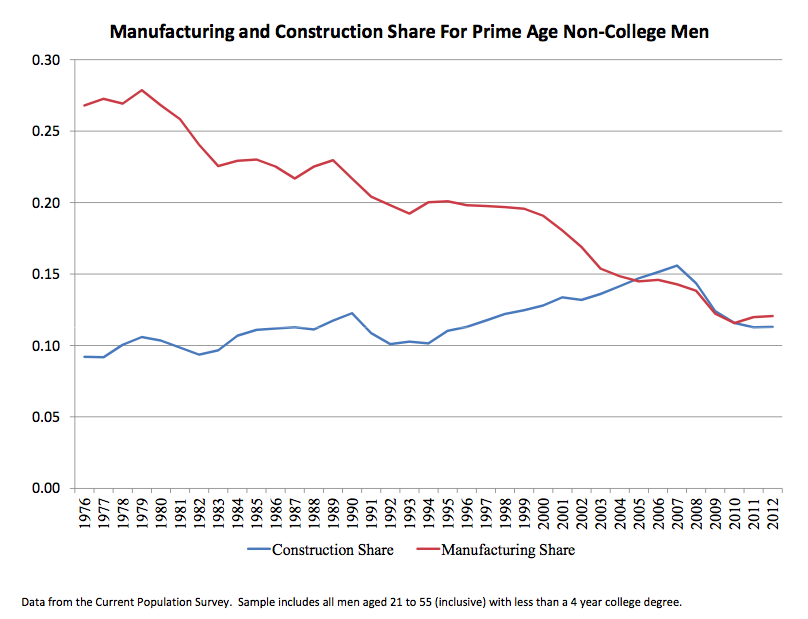

The large increase in housing demand — also called the “housing boom” — significantly increased employment, particularly for workers with less than a college degree. This occurred through the effect of the boom on both increased construction employment as well as increased employment in retail and service industries. While the share of men without a college degree working in manufacturing fell by 5 percentage points during 2000-2007, the share of those men working in construction increased by 3 percentage points (see chart below). The increase in construction activity thus offset a large portion of the manufacturing decline for these men. As we now know, the housing boom proved to be temporary. By 2012, the share of men without a college degree working in construction had reverted to its long run level of about 11 percent.

We emphasize in our paper that increased construction employment was only one labor market effect of the recent housing boom. While it is true that people build more houses when housing demand goes up, they also tap into their home equity more and, as a result, spend more on restaurants, groceries, movie tickets, etc. We show that only about 80 percent of the total employment response for men from the housing boom occurred through increased construction employment. For women, the comparable number was less than 15 percent.

To tease out the effect of manufacturing decline and the housing boom on U.S. labor markets, we compared the experiences of different U.S. metropolitan areas. Some metropolitan areas during the 2000-2007 period received large declines in manufacturing employment and no housing demand boom (e.g., Detroit). Other metropolitan areas during the early 2000s received large housing booms and small declines in manufacturing employment (e.g., Orlando). Using these different metropolitan experiences as “natural experiments”, we are able to estimate the separate effects of manufacturing decline and housing booms on overall employment, construction employment, employment in other sectors, and wages –- all for different demographics groups during the 2000-2007 period and over the entirety of the 2000s.

Using our estimates from this exercise, we calculate that roughly 40 percent of the total decline in the employment-to-population rate in the U.S. during the last 12 years can be attributed to the secular decline in U.S. manufacturing. Additionally, we show that our estimates imply that the housing boom “masked” the labor market effects of the manufacturing decline during the 2000-2007 period. Had it not been for the temporary housing boom, total employment of workers aged 21-55 would have been lower by roughly 1.3 million in 2007. Over the total 12 year period between 2000 and 2011, our estimates imply that the housing market had very little effect on U.S. employment, most plausibly because the gains that the housing boom provided to the aggregate labor market during the boom period were immediate undone during the subsequent housing bust.

Taken together, our results suggest that non-college workers are facing a much worse labor market than they did in either 2000 or 2007. For such workers, manufacturing and housing-related activities are important sectors for employment. The decline in manufacturing employment — at least so far — has been persistent, and possibly permanent. While housing demand increased above long run historical levels temporarily, it has now returned to those historical levels and is unlikely to return to the levels that “propped up” the employment of men without a college degree for a very long time.

We thus conclude that an important share of the current low rate of employment in the U.S. can be understood as a consequence of the ongoing decline in manufacturing, as opposed to factors directly related to the Great Recession. Because of this, we do not expect the employment of displaced manufacturing workers to permanently respond to many of the temporary policies discussed by policymakers in the last few years. Just like the temporary housing boom, temporary tax credits and temporary increases in government spending are unlikely to permanently alter the demand for workers without a college degree.

The historical response to declining demand for less-skilled workers is for workers to accumulate skills that are valued in the labor market, both now and in the future. This explains, in part, why college enrollment rates have been steadily increasing over the last fifty years. In

fact, the return to attending college has never been higher. However, these educational investments take place over a long period of time. Therefore, we do not expect to see the low employment-to-population rates for prime-age workers with less than a 4 year degree to revert back to 2007 levels anytime soon. The consequences of these reduced employment opportunities for millions of less-skilled workers will likely reverberate beyond the labor market and affect both the marriage market as well as the educational attainment of a generation of children who may face reduced economic opportunities as a result of economic decline experienced by their parents.

[1] Data from the March Supplements to the Current Population Survey.

Comments