As my better half is preparing to leave the Obama administration for academic life, we’re packing up our DC apartment and, as typically happens while packing boxes, feeling a bit reflective. So I thought I would share what has made our time in DC so special.

For me, the great joy of being here has been spending time at The Brookings Institution. It’s an extraordinary place, and I’m convinced that I’ll look back on my time here as pivotal in shaping my evolution as an economist.

The rhythm of life for Brookings economists is dictated by the lunch table. This isn’t the usual lunchroom gossip, but rather an ongoing inquiry into the policy debates du jour, with a relentless focus on economics. It’s an intense ordeal, and facts are the only currency accepted. Scholars who are heading up to the Hill, briefing journalists or visiting the White House, will test drive their insights over salads and sandwiches. Survive lunch, and the rest of your day will be easy. Those Formica tables have heard a lot of great ideas improved, and bad ones decimated.

The biggest difference between Brookings and my usual academic gig is the degree of engagement with real public policy questions. And so this year has served as a wonderful education on the messy reality of U.S. economic policymaking.

So Ben Bernanke finally spoke today. And as I predicted yesterday, all the early headlines are expressing disappointment that Ben didn’t announce QE3. But this disappointment is misplaced. New policy announcements are for the Federal Open Market Committee, not the Chairman. The most he could do is give an indication of where he thinks things will go.

And he thinks they should ease policy. Soon.

Here’s the case he made:

1. Unemployment is too high. This is the usual argument for easing monetary policy.

2. Inflation is below target. The usual constraint preventing this doesn’t bind.

3. The possibility that high long-term unemployment may persist “adds urgency to the need to achieve a cyclical recovery in employment.” There’s a special reason to be more aggressive.

On Friday all econ-loving eyes will be focused on Jackson Hole, Wyoming. Think of it as Oscar night for macroeconomists. Except with sensible shoes rather than plunging necklines. But the anticipation and gossip is just as intense. Markets are convinced that Ben Bernanke’s going to make a major announcement. I disagree. Here’s why:

1. Central bankers generally try to be more boring than their audience wants them to be. That won’t change.

2. The run of data since the last Fed meeting hasn’t really changed, so why would monetary policy?

3. Given the slim governing coalition, Ben can’t get too far ahead of the rest of the committee. So look for all the action to come from official Fed statements, rather than cryptic hints at Jackson Hole.

4. Sometimes Fed Chairmen are accidentally more interesting than they mean to be. At last year’s conference Big Ben shared some of his thinking about alternative monetary tools. This was news in 2010, and it excited the markets. But today, we’ve all thought long and hard about the alternatives, so it’s hard to see a surprise coming.

(8/24) Update: It appears that Real Paul Krugman was never on Google+. Instead, it was a hoax by a prankster with an ideological axe to grind. I’ll just say: He was convincing. And I was punk’d.

OK, so I’m in week three of my Twitter experiment. And a funny thing happened along the way. Google Plus. I’m enjoying the conversation at Twitter. But I think G+ is the better technology. So I’ve started posting my more polished (and sometimes more verbose) gems over on Google+.

So far, it’s a bit quiet. But helpfully, Patrick Bernau has compiled a page of economists publicly posting at Google+. So if you prefer Google, you’ll love this page.

I’ve found a lot of the recent discussion about the Fed to be, frankly, confused. So I thought it worth trying to put the issues into a broader context.

Read the Fed’s latest statement, and you’ll see many of the themes I’ve talked about recently. They’ve learned that the economy is not only weak, but that—as I’ve been forecasting for some time—“economic growth so far this year has been considerably slower than the Committee had expected.” Turn to the labor market, and they somewhat dryly note “a deterioration in overall labor market conditions.” And while they won’t use the word double dip, they do note that “downside risks to the economic outlook have increased.” Also, “inflation has moderated.” So there’s plenty of room for them to try to goose the economy. But how?

We all have our favorite business cycle indicators. I have a new one. Last week I was at the (superb!) NBER Summer Institute. And for the first time in 15 years of attending this conference, there was no guacamole on Taco Day. The bad GDP data had come out a mere three hours earlier. Coincidence, or coincident indicator?

No need to convene the Business Cycle Dating Committee: The guacamole has spoken. It’s the first casualty of a double-dip.

I promised to give Twitter a real randomized trial. And so today, it begins. I woke up, flipped a coin, and it came up heads. Which means that today I’ll be tweeting. You can follow me @justinwolfers. What I do tomorrow is up to the coin.

I announced this experiment here three weeks ago, but wanted to spend some time getting used to this new medium. Here are eleven things I learned during my pre-experiment trial:

1. Twitter is fun. And addictive.

2. Information really does move at light speed. I find myself reading tomorrow’s newspaper, today. (But remember: tomorrow’s newspaper will be here in the morning.)

3. As a Twitter-virgin, I hadn’t previously realized how much more it is about sharing links than making glib statements. Hive-mind curation can be extraordinary.

It’s an embarrassing episode. The opening sentence of James B. Stewart’s Tangled Webs: How False Statements Are Undermining America is:

“We know how many murders are committed each year — 1,318,398 in 2009.”

But this is false. As Jeffrey Rosen notes in a savage New York Times review, there were 15,241 murders in 2009. The cited number isn’t just wrong, it’s wrong by two orders of magnitude. Where did the 1,318,398 come from? It’s the number of violent crimes, which includes robbery, rape and assault. And only a small proportion of all violent crimes — a little more than 1 in 100 — are murders.

And so this provides a useful teaching moment for thinking about numeracy. How can you avoid such errors?

I’m a long-time Twitter skeptic. It’s difficult for an economist to see a 140 char lmt as a ftr. My journalist friends tell me I’m dead wrong. And a recent long and boozy evening with co-founders Evan Williams and Jason Goldman convinced me to give it a try. Is Twitter worth the hype? Let’s find out.

Today I’m beginning my Twitter Experiment. I’m now tweeting @justinwolfers. I’m going to keep this up for a couple of weeks as a “burn in” period—basically so that I can learn the ecosystem before my experiment begins. Then on the morning of August 1, I’m going to wake up, and flip a coin. Heads, I’ll open Twitter; tails I won’t. And I’ll do the same on August 2, and then every day for three months. If the coin comes up heads, it doesn’t necessarily mean that I’ll tweet, just that it will be a Twitter-aware day; I’ll consume the stream, and tweet away if I feel the need. Tails, and I’ll simply tweet “Tails, goodbye,” close the stream (unless I need it for research) and then resist the urge to tweet for the rest of the day.

My good friend Andrew Leigh is the winner of the Young Economist Award, granted every two years to the best Australian-based economist under the age of forty. It’s really a rather splendid achievement. And entirely well-deserved.

Andrew’s career has been quite extraordinary. You see, economics was neither his first career, nor is it his current career. He began life as a star lawyer—clerking for the Aussie equivalent of the Supreme Court, and joining one of the big city firms. He then moved on to his second act as a policy advisor for the center-left politicians in both Australia and the UK, and a think tank in the U.S.

Finally, he began his third act, as an academic economist.

I’m a bit late in posting this, but thought it worth posting a recent interview which I did with the brilliant and engaging Chrystia Freeland.

The main point is one I’ve explored here before: the fact that we are halfway to a lost decade. We also explore our longer-run malaise, and my concerns that long-term unemployment may impair our economic recovery.

I spent last week at the Aspen Ideas Festival, talking about Betsey’s and my research on the Economics of Happiness. You might think that my message—that income and happiness are tightly linked—would be an easy sell in Aspen, which is the most beautiful and most expensive city I’ve ever visited. But in fact, it’s the millionaires, billionaires and public intellectuals who are often most resistant to data upsetting their beliefs. You see, the (false) belief that economic development won’t increase happiness is comfortingly counter-intuitive to the intelligentsia. And it’s oddly reassuring to the rich, who can fly their private jets into a ski resort feeling (falsely) relieved of any concern that the dollars involved could be better spent elsewhere.

No one seems to have noticed that the Fed’s latest unemployment projections just don’t make sense. While most economists are concerned about a jobless recovery, the Fed is forecasting lots of jobs, but little recovery. Yes, today’s projections suggest only tepid output growth in the next few years. And given this, it’s hard to see how we will make much of a dent in the unemployment rate. Yet the Fed believes otherwise, cheerfully (wishfully?) forecasting declining unemployment.

On Friday I speculated that perhaps becoming a parent changed how I approach economics. To broaden the discussion, I posed the following thought experiment: what kind of economists would we be if we learned our economics only after we were parents?

The always-interesting Robin Hanson responded:

I don’t need to speculate – I am exactly that kind of economist. I started econ grad school with two kids, ages 0 and 2, and had no undergrad econ… But none of that makes me doubt the value of neoclassical econ. How could it? First, econ makes sense of a complex social world by leaving important things out, on purpose – that is the point of models, to be simple enough to understand… Having an emotional parenting experience is as irrelevant to the value of neoclassical econ as having a mystical drug experience is to the validity of basic physics.

A lot of us were disappointed in the latest jobs report. Non-farm payrolls grew by only 54,000. By contrast, a good recovery requires growth of several hundred thousand jobs a month. But my dinner table conversations with Betsey helped me put it in perspective. (And yes, given her current job, this explains the somewhat political nature of this post.) Her comparison: Through the entire eight years of the (Dubya) Bush administration, non-farm payrolls grew by an average of only 11,000 per month. OK, the Great Recession explains some of this. But not a lot. Let’s cherry-pick the most favorable sample we can, focusing on the period through to the absolute peak in employment, which occurred in January 2008. This still yields average jobs growth of only 66,000.

I’ve been a dad now for a little less than two years, and I’m still trying to figure out how it is shaping my approach to economics. I think the answer is: A lot.

I learned economics in my twenties, before I became a dad. You know the drill: We learned hard math and complex models. Forget the Greek letters, they are just complicated ways of exploring the basic idea informing economics—that people are purposeful, analytic decision makers. And this idea just seemed entirely natural to me. I had always believed in the analytic self; I was rational, calculating, and tried to make smart decisions. Of course real people don’t use math, but I figured that we’re still weighing costs and benefits just as our models say. Or at least that was my understanding of the world.

Today, I’m not so sure.

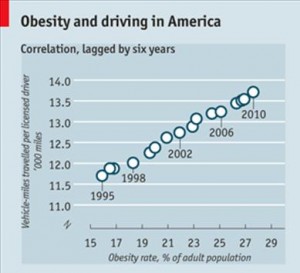

Is higher obesity due to the rise in driving? Perhaps. It’s an intriguing hypothesis. But our friends at The Economist should know better than to report nonsensical correlations. Here’s the evidence they cite (drawn from this entirely unconvincing research paper published in Transport Policy):

Looks impressive, right? (Well, apart from putting the explanatory variable on the vertical axis.) But before concluding that there’s anything here, let’s try a different variable, instead—my age:

Are you likely to have more kids if you are rich or poor? Or to put this in econo-jargon: Are kids normal or inferior goods? (Reminder: When you get rich you buy more of a “normal good,” and less of an “inferior good.” And yes, the language of economics can be a bit cold.)

This is a question that’s central to a debate between Betsey Stevenson and Bryan Caplan. Recall, Bryan is the guy who argues that having kids needn’t be as expensive or time-consuming as we make them. Fair enough. But he then makes the leap to arguing that we should all have more kids. In her response, Betsey noted:

Caplan is entirely focused on the substitution effect: having kids becomes cheaper relative to buying TVs. So he says buy more kids, and fewer TVs. But what about the income effect? As people become richer, they tend to “buy” fewer children, not more. So there’s an offsetting income effect.

In a follow-up, Bryan runs some regressions that he thinks suggest that Betsey is wrong to say that the rich have fewer kids than the poor. It’s a brave person who debates Betsey on the data. And I think he’s tying himself in regression knots, rather than getting at the issue.

OK, so Newt Gingrich’s senior staff have quit. But Newt’s not the news. At least according to the political prediction markets. The real news is that Texas Governor Rick Perry is likely to enter the Republican nomination race. The connection, of course, is that many of the staffers who quit have close ties to Governor Perry.

The figure below tells the story. (Click inside for graph). Since yesterday’s announcement, you can see the markets have re-evaluated Perry’s chances of winning the nomination from around 5%, up to 11%. There’s a tip here for newsgatherers: Focus on the details, and you’ll notice that the Perry’s prediction market rally began just after 11am. But the story broke three hours later, just before 3pm.

I love Google. But it’s not a very good economist. Type “unemployment rate,” and here’s what it yields:

The first of these links is from Google, and it tells you that the unemployment rate is 8.7%. The second is to the Bureau of Labor Statistics, which tells you that it is 9.1%.

Technically, both are correct. But you are better off not relying on the Google number. You see most economic discourse is about seasonally-adjusted data—the unemployment rate adjusted to take account of the usual seasonal ups and downs. But Google links instead to the non-seasonally-adjusted data, which virtually no one pays attention to. And this is why its little graph wiggles up and down so much.

I’ve been writing a bit recently about labor issues, and about topics which touch on administration policy. And my better half, Betsey Stevenson, is currently serving in the administration as Chief Economist at the Department of Labor. So I realized that a disclosure about all of this is probably in order. Rather than mindlessly re-type this disclosure every time I write about anything where there’s any possibility of a conflict, I thought I would outline it all here, now, and just link to this in the future.

Our current slump began a lot earlier than you think. Which means that we’re halfway to a lost decade.

Many people date the financial crisis as beginning when Lehman collapsed in September 2008. But the economy was already in recession. The NBER reckons the recession began in December 2007. But look closely, and you’ll see that it may have begun a year earlier.

That’s the case I made in my latest Marketplace commentary, which you can listen to here. The point is more easily made with a simple graph. (Click inside the story for a bigger version).

The blue line is the usual measure of GDP, which is obtained by adding up total spending. When you read the newspapers, this is the number they report. But the Fed’s Jeremy Nailewaik has convincingly shown that the red line—which is the sum of all income—is the more reliable measure. In theory the two lines should be identical—one person’s spending is another’s income—but in practice, the measurements differ. I’ve also plotted the peak, trough, and latest reading of each measure.

Growing up in Australia, I always knew it was true. And now The Wall Street Journal confirms it:

No worries, mate: Australia may be the world’s happiest industrialized nation by one reckoning, even as it grapples with rising inflation, pricey housing and worries that it is developing a two-track economy.

The resource-rich nation ranked highly in areas such as overall satisfaction, health, leisure time and community networks, according to a new survey released Wednesday by the Organization for Economic Cooperation and Development of the 34 nations that make up its membership. The index found that 75% of Australians were satisfied with their lives, above the U.S. average of 70% and well above the OECD’s average of 59%, while 83% expect things to be even better in five years from now.

Strangely enough, a few years back Danny Blanchflower and Andrew Oswald—perhaps unsurprisingly, a pair of Brits—wrote a paper, “Happiness and the Human Development Index: The Paradox of Australia,” arguing that Australia was surprisingly unhappy. But there really never was a paradox. Instead, the authors were simply over-interpreting two datapoints.

Bryan Caplan’s new book, Selfish Reasons to Have More Kids, (which he blogged about for us here and here) has people talking about happiness and kids, again. Over at Cato Unbound, my better half Betsey Stevenson takes Bryan to task on some of his claims. It’s worth reading the full essay. Jeff Ely at Cheap Talk says you should take note of her views on the distinction between happiness and utility. Instead, I want to highlight an insight that comes from thinking through a formal framework:

This morning the Bureau of Economic Analysis (BEA) released its latest estimates of GDP. And there’s bad news, hidden in the details. Most analysts are focused on the fact that GDP growth in the first quarter of this year was unrevised, remaining at 1.8%. But they’re focused on the wrong number.

National accounting aficionados know that hidden beneath the headline number is an alternative estimate of GDP. This alternative is often called GDP(I), because it is based on income data, rather than spending data. And GDP(I) is actually a more reliable estimate. Unfortunately, this more accurate indicator tells us that GDP grew by only 1.2%. That’s bad news.

You may have heard of Google Trends. It’s a cool tool which will show you the ups-and-downs of the public’s interest in a particular topic—at least as revealed in how often we search for it. And you may have even heard of the first really important use of this tool: Google Flu Trends, which uses search data to try to predict flu activity. Now Google has released an amazing way to reverse engineer the process: Google Correlate. Just feed in your favorite weekly time series (or cross-state comparisons), and it will tell you which search terms are most closely correlated with your data.

So I tried it out. And it works! Amazingly well.

I’m saddened to learn that John Delaney died attempting to reach the summit of Everest. Readers of this blog will know John as the leader of my favorite prediction market, InTrade (and before that, TradeSports). John, or his data, and sometimes his stories, have long graced the pages of this blog, including this Q&A with Dubner. His colleagues know him as an energetic entrepreneur, always trying new things. I also know John as a friend and a collaborator, who was also willing to help crazy academics like myself run new prediction markets, crunch data his markets had generated, or debate what it all means, over a Guinness.

And as much as I knew John as a madcap Irishmen, and true sports fan, I never expected to hear of him drawing his last breath just meters short of the highest peak in the world. Press reports — which include the agonizing detail that John died without knowing his wife just gave birth to a baby girl – are available here and here.

There’s a fascinating debate on happiness going on over at The Economist. Officially, the motion is that: “This house believes that new measures of economic and social progress are needed for the 21st-century economy.” My own contribution tries to discipline the grandiose rhetoric of both sides, concluding that:

[T]he benefits of new happiness data have surely been overstated. But we economists compare benefits with costs. Adding a couple of questions to existing surveys is so cheap that it almost certainly passes any cost-benefit analysis. And when the motion passes, we nerdy social scientists need to stop writing grandiose treatises and get back to the mundane grind of social science, mining these data for yet more incremental insight.

My full argument is available over the fold.

With my better half serving in the administration, I’m spending much of this year visiting Brookings. And every morning, we receive an email, letting us know just what the various Brookings economists are up to. This morning’s edition (written by Daniel Moskowitz) was priceless: Good enough I thought worth sharing with the wider world.

More on John Taylor‘s by-now infamous scatterplot. Earlier, I wrote that I thought he cherry-picked his data, so as to make the link between investment rates and unemployment look artificially strong. Taylor has responded. His observation is considered, and reasonable.

You want to listen to Freakonomics Radio? That’s great! Most people use a podcast app on their smartphone. It’s free (with the purchase of a phone, of course). Looking for more guidance? We’ve got you covered.

Stay up-to-date on all our shows. We promise no spam.